Interest Rates (area of concern)

The FED’s plan of regularly raising interest rates at each of its 2017 meetings appears to still be on course. Twelve of the 16 officials on the Fed’s committee predicted a final rate increase this year (December), the same number as in the Fed’s last round of forecasts in June. University of Michigan’s Research Seminar in Quantitative Economics (RSQE) disagrees, however, predicting that the Fed’s December meeting will delay its next interest rate hike until March 2018 and will then continue to raise rates gradually over the next two years. RSQE cites the US economy’s weak inflation as a reason for possibly skipping a December increase. Janet Yellen’s term as chair ends February, 2018. Whomever President Trump appoints may alter future economic policy. Or, he may also choose to retain Janet Yellen for a second term.

Inflation (area of concern)

Inflation has been a puzzle lately. In recent years, factors such as a decline in commodities and energy prices, a stronger dollar and labor-market slack helped explain why inflation undershot the Fed’s target, but those influences have faded and yet inflation has not rebounded. Meantime, the Fed has managed to formulate plans to shrink its $4.5 trillion portfolio of bonds and other assets starting in October, without provoking much concern from investors. Very odd.

Residential Building Industry (still good news)

Construction employment rose by 28,000 in August, the biggest advance in six months, according to the government. The increase was paced by an 11,500 jump in residential specialty-trade contracting payrolls. That sector has recouped more than half of the 1 million jobs lost as a result of the housing-related economic recession.

National Unemployment (looking good - - and low)

The unemployment rate has declined from 4.8 percent in January to the 4.3 - 4.4 percent range every month since April. Quarterly job openings increased to 5.7 - 5.9 million on average in Q1 and Q2 and exceeded hiring in both quarters. RSQE sees more room for continued low unemployment rates.

West Texas Intermediate Crude (on the low-end of great)

When oil prices are too low, it’s bad for the US energy industry. When they’re too high, consumers cut back spending and many raw material inputs become too expensive for the manufacturing sector. There seems to be a sweet spot where everyone is happy, somewhere between $50-$60/barrel. At that price, the oil industry is making money and consumer prices are not too high. OPEC countries are not happy with $50-$60/barrel, however, and typically try to increase worldwide prices by cutting back on their production.

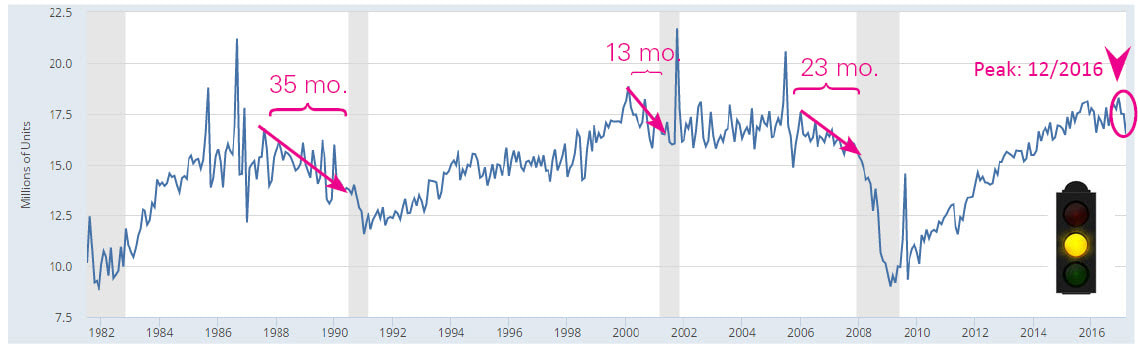

Auto and Light Truck Sales (area of concern)

Sales of new light vehicles have slowed markedly in recent months. At an annual rate, the industry was barely reaching 16 million in August. Car sales have been, on average, 10% lower over last year. Light trucks haven’t been nearly as affected, only down 2% over last year. Automakers’ Q3 and Q4 production plans are projected to be 14%-23% lower than last year. Following our period of vigorous growth from 2009 to 2015, this is consistent with a maturing economic expansion.

The Bottom Line

We all know a recession is coming; it’s what economies do. The average duration of a US recession is 11 months. The longest recession we’ve endured in recent history was the Great Depression (43 months). The second longest was the Great Recession (18 months). Ten years is the longest stretch we’ve gone between recessions, and we’re currently 8 years and 4 months since our last. Signs seem to point to a recession beginning sometime in the next 24 months, but we wouldn’t be disappointed if it waited a little longer.

RSS Feed

RSS Feed